WHY DO YOU NEED A Protection Plans FROM Premier Financing?

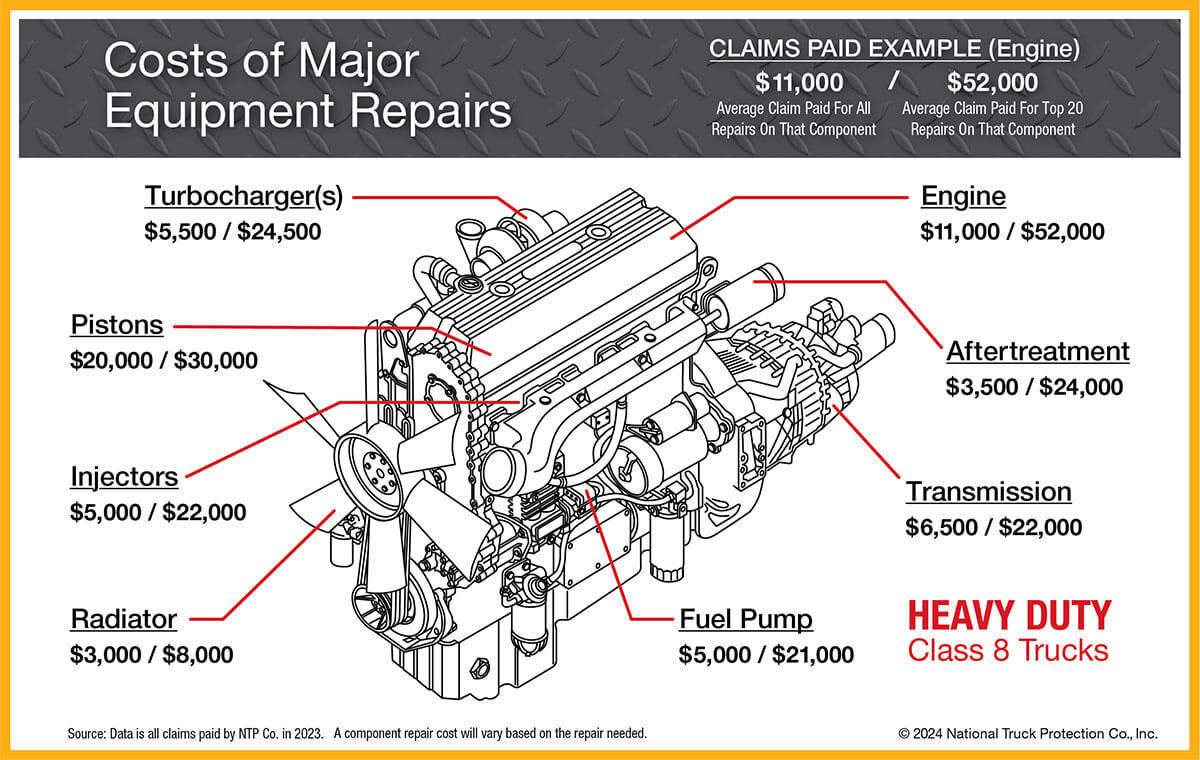

- Today’s commercial vehicles are high-tech marvels of engineering that deliver unparalleled fuel economy and reliability. However, with technical sophistication also comes vehicle components that can be costly to replace should they fail.

- Premier Financing extended coverage plans cover a wide range of components including engines, transmissions, injectors, turbochargers, aftertreatment systems and much more.

- Components could cost up to 100% more than a similar component did less than 10 years ago.

- Premier Financing extended coverage plans are available from 12 months/100,000 miles to 48 months/400,000 miles for most purchases.

- Comprehensive extended coverage plans from Premier Financing are critical to assuring that you maintain the cash flow needed to run your business and the peace of mind to focus on achieving your transportation goals.

GAPCoverage

GAP Protection Program

Protect Your Truck and Your Wallet

Did you know that if your vehicle is stolen or declared a total loss, you may still be responsible for paying off a portion of the vehicle finance contract?

Many people owe more on their finance contract than their insurance company will pay in the event of total loss. GAP is an amendment to a vehicle finance contract that waives a portion or all of what you owe on the finance contract after an insurance settlement is paid for the total loss of a vehicle. GAP will also pay for your insurance deductible (where permitted by state).

Always be Prepared

You may think it won’t happen to you, but the theft or total loss of a vehicle can take you by surprise. The surprise can be twice as unpleasant if your primary insurance carrier’s settlement is less than the amount

needed to pay off your finance contract’s outstanding balance.

Major Components Repair Costs Range

The high cost to repair one major equipment failure could put your business in jeopardy. A Premium 2000+ Protection Plans will protect your business, your investment and your livelihood.

Roadway Advantage Platinum Coverage

Program Benefits:

The roadside assistance reimbursement program was created to help truck owner/operators maximize their cash flow and ease the burden of unexpected over the road expenses. The Roadway Advantage Program (RAP) product was initially launched for heavy duty trucks. It provides reimbursement for roadside assistance expenses such as towing, labor, trip interruption, flat repair, battery boost, pull start, lockout service and fluid & parts delivery.

RAP includes best-in-class customer service and claims processing to ensure truck owner/operator needs are met in an expedited manner. All claims are processed by Roadway Advantage, Inc. and operations are not outsourced throughout the process. As a result, payment is usually made within 24 – 48 hours of claim submission.

Receive up to $1,500 towards towing services for a covered vehicle from the site of your breakdown to a local licensed repair facility of your choice.

Storage fees are not covered. Toll fees are not covered.

Receive up to $1,000 towards labor for roadside assistance service on a covered vehicle at the location of the breakdown. Includes emergency fuel delivery (cost of fuel not included) and mechanical repair.

Parts & Materials are not covered. Labor at shop/facility is not covered.

Receive up to $750 for a hotel room while you are waiting for your vehicle to be repairedwhen you breakdown away from home.

Surcharges/Entertainment costs are not covered.

Receive up to $300 towards each service for a covered vehicle.

Parts & Materials are not covered. Labor at shop/facility is not covered.

Receive up to $200 towards opening a locked door of a covered vehicle.

Parts & Materials are not covered. Labor at shop/facility is not covered.

Towing, Roadside Assistance, and Trip Interruption coverage applies. Parts & Materials are not covered. Labor at shop/facility is not covered.

Limitations:

- RAP is NOT insurance or protection plan of any kind and is not transferrable.

- Claims must be breakdown related and incurred over the road. Breakdowns at the home base or where unit is stored are not considered roadside or over over the road, and are therefore not covered.

- Coverage applies to tractor/power unit only. Coverage for trailer is available under separate program.

- Service must be performed by a licensed provider. Unit cannot be more than 9 years old at the time of enrollment.

- Accident/Maintenance/Adjustments/Weather/Acts of God or similarly related claims are NOT covered.

- Limit of $1,750 per claim. Maximum five claims per enrollment year.

- NO COVERAGE for any service not specifically listed above.

Road Hazard Tire & WheelCoverage

Tire & Wheel Replacement: $600

Reimburses for replacement of unit tire / wheel

Covered Items |

|---|

| Tire / wheel replacement due to: non-repairable road hazard such as puncture, bruise, or impact break. |

Non-Covered Items |

|---|

| Damage caused by: collision, accidents, vandalism, snow chains, mechanical defects of the truck, willful abuse, or negligence. |

Sonsio Tire & Wheel Program Details:

- Coverage is not insurance or rotection plan of any kind and is not transferable or refundable

- $600 maximum limit per claim

- Unlimited claims for length of contract

- NO MAXIMUM tire replacements during the coverage term

- Claims must be replacement related and incurred over the road. Damage incurred at the home base or where the unit is stored is not considered roadside or over the road and is therefore NOT covered

- Tires with tread measuring less than 3/32” are NOT covered

- Tire replacement service must be performed by a licensed provider

- You must purchase the replacement tire. You will be reimbursed for the replacement once all required documentation has been submitted and approved

- The reasonable cost of mounting, demounting, valve stems and disposal for any tire replaced and/or wheel repaired or replaced due to a covered road hazard is included.

- Accident / Maintenance / Adjustments / Hazmat Clean-up / Vandalism / Weather / Acts of God or similarly related claims are NOT covered

- NO COVERAGE for any service not specifically listed above.

Frequently AskedQuestions

While we would like trucks to last forever, we know that all vehicles will eventually need parts and service repairs. Protecting your investment and ensuring steady business operations is one of your most important decisions along with purchasing a truck. Our coverages allow you to focus on operations and profitability, not on paying for a large, unexpected repair bill.

Each provider we work with is trusted in the industry and has a strong relationship with Premier Financing. Depending on the make, model, age, and mileage of your vehicle, coverages and availability varies, so our Protection Plans experts make sure to match the coverage that best meets the needs of your vehicle and your business model.

Roadway Advantage is our partner company who provides you with reimbursement for roadside events, such as towing, road service, and lodging accommodations. The Roadway Advantage Platinum coverage allows you to submit qualifying bills, up to 5 claims per year of up to $1,500 per claim. Towing and roadside labor costs can be expensive, so purchasing a coverage package protects you from unexpected bills. And you get your money fast! Most claims are paid within 24-48 hours of receipt.

Have questions? Ask a Pro!

Jermain Long

Director Of Financing

Phone: (610) 592-6990

Dave Wirth

Vice President of Finance and Insurance

Phone: (972) 225-4345

Chad Lewis

Financial Services Administrator - Customer Service

Phone: (610) 234-5782

Jordalina Salcedo

Title Coordinator

Phone: (610) 234-5770

Vy Le

Senior Financial Services Manager

Phone: (610) 234-5775

Joel Powers

Senior Financial Services Manager

Phone: (610) 234-5781

Ashlee Pierce

Financial Services Administration Manager

Phone: (610) 220-3931

Kelly Dugan

Financial Services Administrator Supervisor

Phone: (610) 234-5780

Brian Rowe

Financial Services Manager

Phone: (610) 234-5790

Calvin Jones

Financial Services Manager

Phone: (610) 234-5773

Cody Adams

Financial Services Manager

Phone: (610) 234-5704

Dave McPherson

Financial Services Manager

Phone: (610) 234-5750

Leonard Prieboy

Financial Services Manager - Chicago

Phone: (610) 234-5784

Mary Ingram

Financial Services Manager

Phone: (610) 234-5771

Raymond Dubbs

Financial Services Manager

Phone: (610) 234-5769

Tim Stork

Financial Services Manager

Phone: (610) 234-5749

Paul Hutchinson

Financial Services Manager - Canada

Phone: (610) 234-5764

Alex Carino

Financial Services Administrator

Phone: (610) 234-5776

Cheyenne Rudis

Lead Financial Services Administrator

Phone: (610) 234-5786

Erica Witt

Financial Services Administrator

Phone: (610) 234-5706

Kayla Madden

Financial Services Administrator

Phone: (610) 234-5778

Theresa Cocuzza

Lead Financial Services Administrator

Phone: (610) 234-5772

Yves Charles

Financial Services Administrator

Phone: (610) 234-5768

Zack Scheffler

Financial Services Administrator

Phone: (610) 234-5764